How to Deal with Insurance After a Car Accident in Arkansas

Insurance companies make billions of dollars a year in profits offering Americans peace of mind. They promise that if you pay your premiums on time, they’ll be there when catastrophe strikes. Unfortunately, this isn’t always true.

Many insurance companies take advantage of injured accident victims and their fragile physical and emotional states after a crash. They often offer a lowball settlement and use a harsh “take it or leave it” approach in order to pressure crash victims into signing quickly.

If you’ve been injured in a car crash in Arkansas, we can help. Our car accident attorneys know the insurance company’s tricks and tactics and we use this knowledge to fight aggressively for our clients.

Contact our 24/7 Injury Lawyers

Respect

We treat all our clients with the utmost respect.

No fee

Our No Fee Guarantee® means you pay us nothing unless we win your case.

24/7 access

You get access to our legal team anywhere, anytime.

NATIONALLY RESPECTED. LOCALLY TRUSTED.

- Why are Insurance Companies so Difficult?

- How to Handle the Insurance Companies

- Insurance Adjusters from Your Own Insurance Agency

- What is a Duty to Cooperate?

- What is a PIP Application?

- What Happens When You’re At Fault?

- Insurance Adjusters from Other Party’s Insurance Agency

- Never Submit a Recorded Statement

- Signing Documents

- How to Handle Offers and Settle Your Case

- What is Betterment?

- Case Results

- Contact Us

Why are Insurance Companies so Difficult?

The insurance industry in the United States enjoys average profits of over $30 billion a year and CEOs in this industry make more than CEOs in any other industry. How do they get so profitable? By delaying, denying, and refusing claims to their policyholders. This unethical behavior has been well documented throughout the years, however, these deceitful policies and tricks continue. In fact, some of the largest insurance companies, like Allstate, State Farm, AIG, and Progressive, have denied valid claims simply to boost their profits. They even go so far as to reward employees who successfully deny the most claims every month.

Insurance companies make more money when injured accident victims settle for the lowest amount possible. In order to achieve this, they often confuse their consumers with incomprehensible contracts and indeterminate language. They delay claims in the hopes that policyholders won’t fight too hard to continue them. And they deny claims when all else fails.

How to Handle the Insurance Companies

Handling the insurance company is difficult, and often involves:

- Notifying your insurance company of the crash

- Notifying the “at fault” driver’s insurance company of the crash

- Cooperate with the investigation of the crash

- Giving recorded statements

- Reviewing documents and evidence

- Researching the cost of repairs and reimbursement for expenses

- Negotiating settlement offers

Insurance Adjusters from Your Own Insurance Agency

The insurance adjuster from your own insurance agency is the person assigned to your case. They will determine how much money your own policy will pay for liability or property damage. To do this, they will need to discuss your accident with you and investigate the damage. A dollar value will be assigned to the damage for your car or for your property. Your policy limits will determine how much you are able to receive. If you’re at fault for the crash, then your insurance adjuster will also negotiate with the injured party to settle their claim.

If You Have Been Injured in a Car Accident, Call Us Today!

What is a Duty to Cooperate?

Your policy likely has a provision stating that you have a “Duty to Cooperate” with the insurer during the investigation and during the defense of a claim. Once you’ve submitted a claim with your insurance company, your adjuster may request financial statements, bank records, and income tax returns from you. While this may seem excessive, failure to comply with the adjuster’s requests could be seen as a violation of your policy, which could result in your claim being denied altogether.

What is a PIP Application?

A PIP claim is a personal injury protection claim and it has to do with “no fault insurance.” If you have this insurance it will provide benefits, such as medical expenses, disability benefits, and accidental death benefits to you when you are injured in an accident, regardless of who is “at fault.” This can be extremely beneficial if you caused the accident or if you were involved in an accident with an uninsured driver.

What Happens When You’re At Fault?

Each insurance company will investigate the accident and determine who is at fault for the crash. If you’re at fault, your insurance adjuster will need to negotiate a fair settlement with the injured accident victim and their insurance company. If you are sued by another driver, your insurance adjuster will also represent you in court. Your insurance adjuster will be building a case designed to reduce the injured party’s settlement. To do this, they may request recorded statements, or they may investigate the accident more closely to assign some of the blame on the other driver if possible

Never Submit a Recorded Statement

While you have a duty to cooperate with your own insurance company, you do not have the same duty to cooperate with the “at fault” driver’s insurance company. As such, when their insurance adjuster requests a recorded statement – say “No!” Why? Insurance companies will compare this statement to other statements you’ve made at the scene of the accident to find any reason to deny your claim. Even minor inconsistencies can be the evidence they need to deny your claim. They will also ask you questions worded specifically to trap you into making mistakes that will hurt your case. They may try to push you into agreeing with their version of the accident or with the details of the case. Never record a statement without first speaking to an experienced personal injury attorney.

Even friendly chit-chat can backfire. If you are approached by the other driver’s insurance adjuster here are some ways you can avoid falling into their traps:

Signing Documents

Never sign any documents without first speaking with an experienced Arkansas personal injury attorney. You may be inadvertently signing away your rights to future compensation. During a claims process, you may be asked to sign numerous forms and documents. While some of these forms may seem innocent, they may not be.

For example, the insurance adjuster may request that you sign a medical release form. This may seem like an easy form to sign, but it can significantly jeopardize your case. Signing this release form gives the insurance company permission to review all of your medical records, past and present. They may then use your past medical history to reduce or deny your claim altogether. They will also look for any indication that you aren’t as injured as you claim to be. Did you miss any appointments? Did you neglect to fill any prescriptions?

As you can see, it is never a good idea to sign documents without a lawyer present. Your insurance adjuster is not a lawyer and cannot explain the full legal consequences of signing these forms. Your lawyer can not only protect your rights to full compensation, but they can also prepare you for what’s ahead. Your attorney can advise you to review your own medical records first, so you can know what the adjuster may use against you. This will give you the best chance of fighting them and obtaining the money you need to fully recover.

What is Betterment?

Betterment occurs when fixing a vehicle causes that vehicle to improve in condition or in value. When you’re making a car accident claim, you’re expected to pay this betterment charge when repairs put your vehicle in a better condition than before the crash. An insurance company’s sole responsibility is to put you back to the same financial position you were before – not a better one. For example, perhaps your car’s radiator was on its last leg before your crash. After your crash, you obtained a new radiator and a significant increase in value. The insurance company could request that you pay the difference.

To counter betterment charges, you will have to prove that the parts will not actually increase the value of your car at all. Perhaps your car is so old that even with a new radiator you could not ask for more money for it on the market. To win this type of claim, you must get testimony from an expert in auto repairs or a qualified mechanic.

As with all claims, you only have a specified amount of time to settle your case. Injury accidents in the state of Arkansas must file claims within three years. In some cases, you may only have as little as a few months to file your claim, therefore, you must act quickly after a crash. An insurer in Arkansas has only 15 days to acknowledge your claim after they’ve received it. The carrier must also complete their investigation within 45 calendar days of opening the claim. If they can’t complete the investigation within this time frame, they must advise the insured of why they request more time. After the close of an investigation, the insurer only has 10 days to deliver all claim checks.

Auto Accident Resources

Understanding Vehicle Rollovers: A Comprehensive Guide

Rollover accidents can be severe and complex — drivers must understand how they can happen, how to avoid them, and

What Happens To Your Body In A Car Crash?

A car crash can have significant physical and emotional effects on you—so it’s important that you have time to focus

What Happens if You Crash a Leased Car?

After getting into an accident with a leased car, you should make sure that everybody involved is safe, then report

What to Do if the Other Driver Leaves the Scene of an Accident

If you get into an accident and the other driver leaves the scene, the first thing you should do is

How Much Money Can You Get From a Car Accident?

While the typical car accident settlement will fall between $5,000 and $100,000, your specific recovery could range from a few

What Happens if Someone Else Is Driving Your Car and Gets in an Accident?

In Arkansas, insurance generally follows the vehicle: So, if you give someone permission to use your car and they crash

Dog Bite

If you suffered an injury from a dog bite attack, you should be able to focus on healing. Our team

Average Car Accident Settlement Amount

Many factors influence the settlement you’ll receive after a car accident. Because no two accidents or injuries are identical, it’s difficult

Understanding Head Injuries from Car Accidents

If you’ve suffered a head injury in a car accident, you’re not alone. According to the Centers for Disease Control

What to Do After a Car Accident in Arkansas

Immediately after a car accident, you should turn on your hazard lights, get to safety, and try to remain calm.

Common Causes : Truck Sleep Apnea

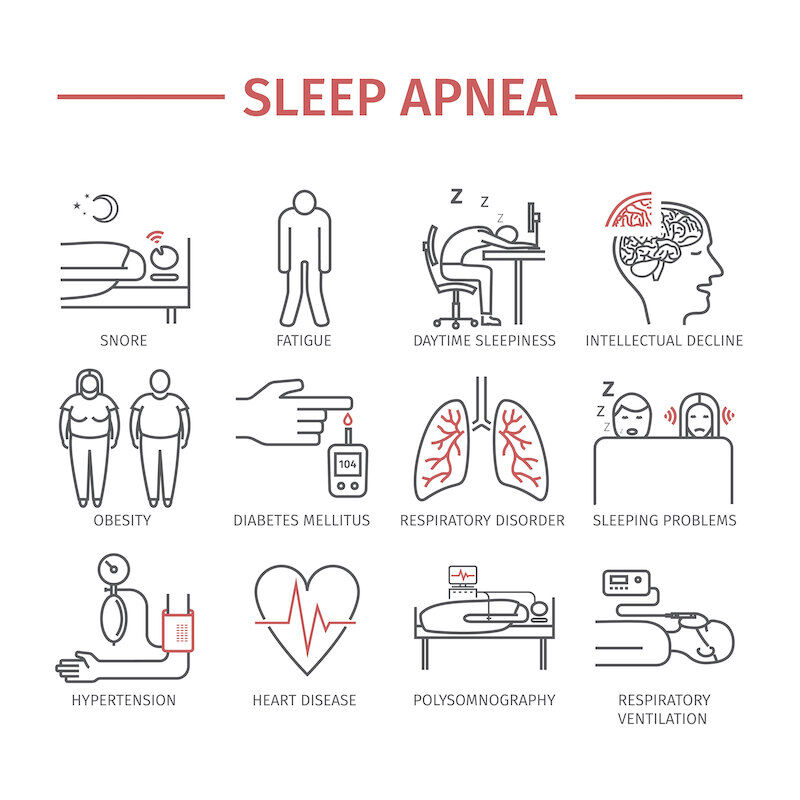

Every year, there are 15 million commercial trucks on our nation’s roads. These trucks transport over 70 percent of our country’s

Safety Tips to Prevent Truck Accidents

Across the United States, there was an increase in the number of trucking accidents in 2016. That year alone, more than

Trailer Detachment Accidents

Common Causes of Big Truck Accidents Sharing the road with large commercial trucks can be scary. After all, a fully loaded

Driverless Trucking & Its Impact on Car Accidents

Dozens of companies are currently testing and developing self-driving trucks. These trucks are expected to hit the road as early as

Common Causes of Motorcycle Accidents

Motorcyclists in Arkansas face a variety of obstacles, challenges, and risks when riding on the road. However, the most common risk