How to Appeal a Denied Auto Insurance Claim?

Insurance adjusters look for any excuse to deny your car accident insurance claim. You might already know this if you received a claim denial.

Receiving a claim denial after a car accident can put a significant financial burden on you and your family. It can also make you feel scared and angry. After all, aren’t insurance companies supposed to be on your side after an accident?

The cold reality is that insurance companies are NOT on your side. After a crash, their main goal is to pay you as little as possible. This is unfair, and without a legal team, you may feel helpless to fight back.

Fortunately, there are ways you can fight auto insurance claim denials and win. With Rainwater, Holt & Sexton on your side, you can hold insurance companies to the task of paying you what you deserve. Our Arkansas auto accident lawyers know how to fight uncooperative insurance companies.

Contact our 24/7 Injury Lawyers

Respect

We treat all our clients with the utmost respect.

No fee

Our No Fee Guarantee® means you pay us nothing unless we win your case.

24/7 access

You get access to our legal team anywhere, anytime.

NATIONALLY RESPECTED. LOCALLY TRUSTED.

How to Fight an Insurance Claim That’s Been Denied

When an insurance claim gets denied, you may feel frustrated and stressed, especially if you are still dealing with medical bills and other costs related to the accident. Fortunately, if the insurance company denies your car accident claim, you can fight back.

The first thing that you should do is review the denial letter from your insurance company. In some cases, a simple mistake may have resulted in the denial. If the rejection is based on something more serious, such as the insurance company saying that your policy does not cover your injuries, you will need to take additional steps.

You should review your insurance policy to determine your coverage. Knowing your policy limits and coverages is key to receiving the compensation you deserve.

The next step is to submit a claim appeal letter. Explain in your appeals letter the reason you believe your claim should’ve been accepted. Include any evidence you have, such as photographs, eyewitness reports, and medical records.

Appealing an insurance claim denial is complex and requires the experience and skills of an auto accident lawyer. Your attorney will need to examine your claim denial letter and policy to understand why the insurance company denied your claim. Your lawyer can then gather the evidence you need to win your appeal.

What Do I Do If I Received a Settlement Offer Letter Instead?

A settlement offer letter proposes a resolution to a car accident dispute. The letter usually outlines the terms of the proposed settlement, including any financial compensation involved.

The settlement offer letter is typically the first step in negotiations between the parties involved. If both sides can agree on the terms of the settlement, then a formal agreement is drafted and executed. If not, the negotiation process continues until an agreement is reached or until one party decides to walk away from the negotiation.

If you receive a settlement offer letter, it means that the insurance company has decided to offer you a certain amount of money to settle your personal injury claim. While it is up to you whether or not to accept the offer, you should keep a few things in mind before making a decision.

First, you should make sure that you understand all the terms of the offer. The insurance company will often include a release of liability. This means you give up your right to sue the at-fault party if you accept the settlement. For this reason, any offer you agree to must adequately cover all of your medical expenses and any lost wages from time missed at work.

Once you have reviewed the terms of the offer, you can either accept or reject it. If you decide to accept the offer, you will need to sign and return the release of liability. Once the insurance company receives the signed release, they will send you a check for the settlement amount.

If you reject the offer, you can continue negotiating with the insurance company or file a personal injury lawsuit. An experienced Arkansas car accident attorney can help you determine whether or not filing a lawsuit is in your best interest.

If You Have Been Injured in a Car Accident, Call Us Today!

Why Did Your Car Insurance Company Deny Your Claim?

There are numerous reasons why a legitimate insurance claim gets denied. Understanding those reasons can give you insight into how to fight these denials.

Some of the top reasons why insurance companies reject most claims include the following:

Insurance Policy Has Expired

This one is simple – if the at-fault driver’s policy has expired, the insurance company will deny the claim against the at-fault driver’s insurance policy. When the at-fault driver lets their insurance policy lapse, you can make an uninsured motorist claim through your policy. This is one reason you must ensure you have purchased a “full coverage” policy.

Policy Exclusions

Policy exclusions are one of the most common reasons for a car accident claim denial. Policy exclusions are clauses in your insurance policy that specifically exclude certain types of accidents or damages from being covered.

For example, if you have a policy exclusion for “acts of God,” your insurer can deny your claim if they determine that the accident was caused by something beyond your control, like severe weather. Other standard policy exclusions include those for pre-existing damage, alcohol-related accidents, and accidents that occur outside of the country.

If your insurance company denies your claim due to a policy exclusion, you may still be able to appeal the decision.

Your Plan Doesn’t Have Full Coverage

In Arkansas, an automobile owner is allowed to reject full coverage. The law only requires drivers to carry liability. If you are at fault, your insurance will cover the other driver who wasn’t at fault, but you will have nothing to pay you for your expenses incurred and sustained losses.

For this reason, drivers should purchase a more comprehensive plan whenever possible. This comprehensive plan might include full coverage, Personal Injury Protection (PIP), or uninsured motorist coverage.

Full coverage includes liability insurance that protects the other driver when you are at fault. Personal Injury Protection provides medical payment insurance to pay your medical bills and also provides some wage-loss protection. Uninsured motorist coverage applies when the other driver is at fault but has no liability insurance.

You might have selected a liability plan because it was the most affordable, but make sure you know what is at risk when you choose the cheapest option.

Uninsured Motorist Accidents

Uninsured Motorist Protection (UM) applies when the other driver is at-fault but does not carry insurance at all. Underinsured Motorist Protection (UIM) applies when a driver carries the bare minimum insurance, and this isn’t enough to pay your damages.

If you get into an accident with an uninsured motorist, the insurance company will deny your claim if you don’t have a UM/UIM policy.

You Committed a Crime

If you were under the influence of drugs or alcohol and caused an accident, your insurance company will not cover expenses caused by your negligence. If you committed a crime at the time of the accident, the insurance company might deny your claim due to your negligence.

Your Driver’s License is Invalid

If you’re involved in a car accident and don’t have a valid driver’s license, your insurance company may deny your claim. This is because they may view you as a high-risk driver.

There are a few ways to avoid this situation. First, make sure that you always have a valid driver’s license. If your license has expired, make sure to renew it before driving. Secondly, if you’re involved in an accident, be honest with your insurance company about your status. They may be more likely to work with you if you’re upfront about the situation.

You’re an Excluded Driver on the Policy

Some insurance policies name specific drivers who are excluded from coverage. This means that the policy will not cover damages caused by those drivers. The insurance company will deny the claim if you’re an excluded driver on a policy.

You Didn’t Report the Incident on Time

Don’t wait to report an incident to your insurance company. They have the right to argue that they didn’t have enough time to research a claim if a significant amount of time has passed since the accident.

There is a Liability Dispute

An insurance adjuster could reject your claim because there’s been a dispute about who was at fault. They could also disagree with the damages you’re claiming. To avoid a dispute with your insurance company, a police report, photos of the scene, damage, and witness testimonials can help.

Bad Faith

Bad faith in the insurance industry can result in a car accident claim getting denied. This is because insurance companies must act in good faith when handling claims. If an insurance company acts in bad faith, it can face liability for damages.

There are several ways that bad faith can result in claim denial. For instance, an insurance company may deny a claim without investigating it. Or, an insurance company may refuse to pay a claim without giving a reason. Additionally, an insurance company may try to delay the payment of a claim.

If you received a claim denial after a car accident, you might have grounds for a bad faith claim against your insurance company. An experienced Arkansas personal injury attorney can help you understand your legal options.

Appeal Your Car Insurance Claim Denial

If you are appealing a car insurance claim denial, there are some specific steps you will need to take. The appeals process is often difficult and time-consuming. To avoid unnecessary delays, it is best to have this process handled by an experienced Arkansas car accident attorney.

Your attorney will go to work appealing your claim denial while you focus on your recovery and on rebuilding your life after a car accident. To do this, your attorney will:

Gather Evidence

If you’ve been denied a car insurance claim, don’t despair. You may be able to appeal the decision and have your claim paid. The first step is to gather evidence to support your appeal. This may include:

- Documentation of the damages incurred

- Eyewitness statements

- Photographs of the accident scene

- Bill of Rights

- Insurance policy information

- Medical reports

- Police reports

Draft an Appeal Letter

Once you have the necessary evidence and information, you’ll need to write a letter to your insurance company outlining your case and requesting a review of the decision. This is an appeal letter.

If your insurance company denies your appeal, you can file a complaint with the state insurance commissioner’s office. This office will investigate your claim and determine if the denial was justified. They may order the insurance company to pay your claim if they find it wasn’t.

Auto Accident Resources

Understanding Vehicle Rollovers: A Comprehensive Guide

Rollover accidents can be severe and complex — drivers must understand how they can happen, how to avoid them, and

What Happens To Your Body In A Car Crash?

A car crash can have significant physical and emotional effects on you—so it’s important that you have time to focus

What Happens if You Crash a Leased Car?

After getting into an accident with a leased car, you should make sure that everybody involved is safe, then report

What to Do if the Other Driver Leaves the Scene of an Accident

If you get into an accident and the other driver leaves the scene, the first thing you should do is

How Much Money Can You Get From a Car Accident?

While the typical car accident settlement will fall between $5,000 and $100,000, your specific recovery could range from a few

What Happens if Someone Else Is Driving Your Car and Gets in an Accident?

In Arkansas, insurance generally follows the vehicle: So, if you give someone permission to use your car and they crash

Dog Bite

If you suffered an injury from a dog bite attack, you should be able to focus on healing. Our team

Average Car Accident Settlement Amount

Many factors influence the settlement you’ll receive after a car accident. Because no two accidents or injuries are identical, it’s difficult

Understanding Head Injuries from Car Accidents

If you’ve suffered a head injury in a car accident, you’re not alone. According to the Centers for Disease Control

What to Do After a Car Accident in Arkansas

Immediately after a car accident, you should turn on your hazard lights, get to safety, and try to remain calm.

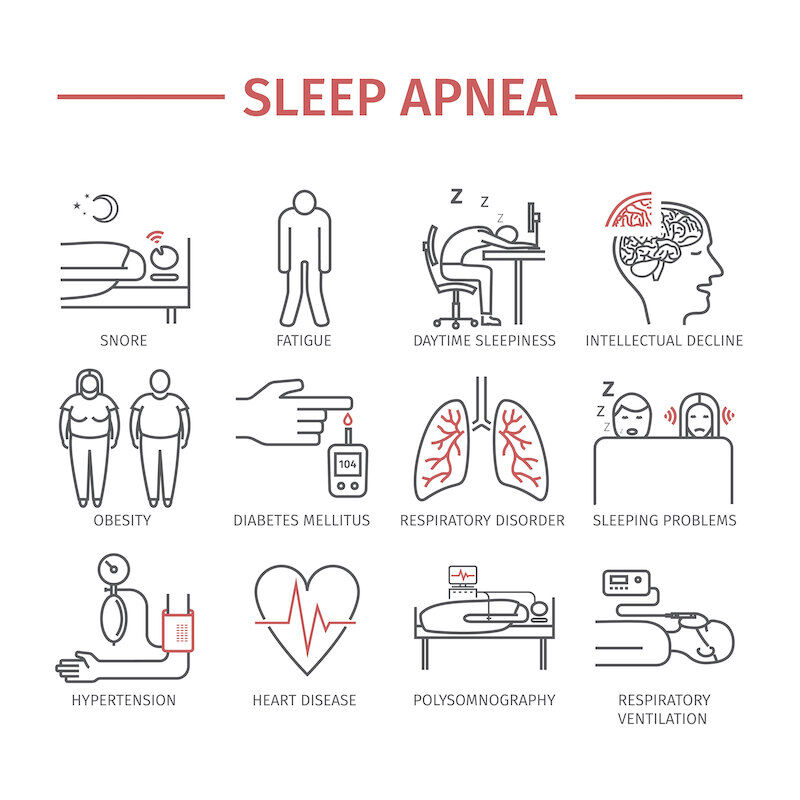

Common Causes : Truck Sleep Apnea

Every year, there are 15 million commercial trucks on our nation’s roads. These trucks transport over 70 percent of our country’s

Safety Tips to Prevent Truck Accidents

Across the United States, there was an increase in the number of trucking accidents in 2016. That year alone, more than

Trailer Detachment Accidents

Common Causes of Big Truck Accidents Sharing the road with large commercial trucks can be scary. After all, a fully loaded

Driverless Trucking & Its Impact on Car Accidents

Dozens of companies are currently testing and developing self-driving trucks. These trucks are expected to hit the road as early as

Common Causes of Motorcycle Accidents

Motorcyclists in Arkansas face a variety of obstacles, challenges, and risks when riding on the road. However, the most common risk